Balance Transfer Credit Cards with 0% APR & No-Fee Options

Balance transfer credit cards can help you cut interest, consolidate debt, and pay balances faster.

In this guide, you’ll learn what a balance transfer credit card is, exactly how to balance transfer a credit card,

and how to find the best balance transfer credit cards with 0% APR and no-fee options.

We’ll walk through the full process—how to transfer a balance from a credit card step-by-step,

common fees (like 3%–5% transfer fees), and when a no interest credit card balance transfer makes sense versus a low-APR offer.

You’ll also see issuer-specific tips for Chase, Capital One, and Bank of America, plus practical examples so you know what to expect.

What you’ll get here:

- Clear definitions: what is a balance transfer credit card and how it actually saves money.

- How-to: how to balance transfer credit card—from application to payoff strategy.

- Top picks: the best balance transfer credit cards including 0% balance transfer credit card deals and no fee balance transfer credit cards.

- Cost calculator tips: know the real cost of moving $1,000+ after fees and promo APR.

- Eligibility & alternatives: options for fair/bad credit and when a personal loan may be smarter.

By the end, you’ll be able to compare offers confidently, avoid common pitfalls, and choose the balance transfer path that fits your budget and payoff timeline.

2. What Is a Balance Transfer Credit Card?

A balance transfer credit card is a financial tool that lets you move debt from one credit card to another—usually to take advantage of a lower interest rate or even 0% balance transfer credit card offers. Instead of paying high APR on your existing card, you can transfer the balance to a new card with a promotional period of no interest credit cards balance transfer, often lasting 12 to 21 months.

These cards are designed for people who want to save money on interest and pay off debt faster. However, not everyone qualifies. Approval typically depends on your credit score, income, and overall debt-to-income ratio. If you already have good to excellent credit, you’re more likely to be approved for the best offers with the longest 0% APR periods and no balance transfer fees.

💡 Pro Tip: Before applying, check if the card issuer offers a prequalification tool. This lets you see your chances of approval without impacting your credit score.

3. How Does a Balance Transfer Work?

The process of how to balance transfer credit card debt is straightforward, but it’s important to understand each step to maximize the benefit. Here’s what typically happens:

- Choose the right card: Compare balance transfer credit card offers and look for 0% APR promotions and low or no fees.

- Apply for the new card: Submit your application online. Once approved, request to transfer a balance from a credit card to the new account.

- Old balance paid off: The new issuer pays your existing card balance directly, closing or reducing the debt on your old card.

- Repay the new card: You now owe the balance to the new bank. During the promotional period, interest is waived—giving you a window to aggressively pay down debt.

🔎 Example: If you have $5,000 in debt at 22% APR, transferring to a card with a 0% APR for 18 months and a 3% fee ($150) could save you over $1,000 in interest—provided you pay the balance before the promo period ends.

⚠️ Financial Tip: Always calculate the balance transfer fee vs. the interest you’d save. If the fee is too high or you can’t pay off the balance within the promo period, the card may not be the best choice.

4. Best Balance Transfer Credit Cards (Comparison Table)

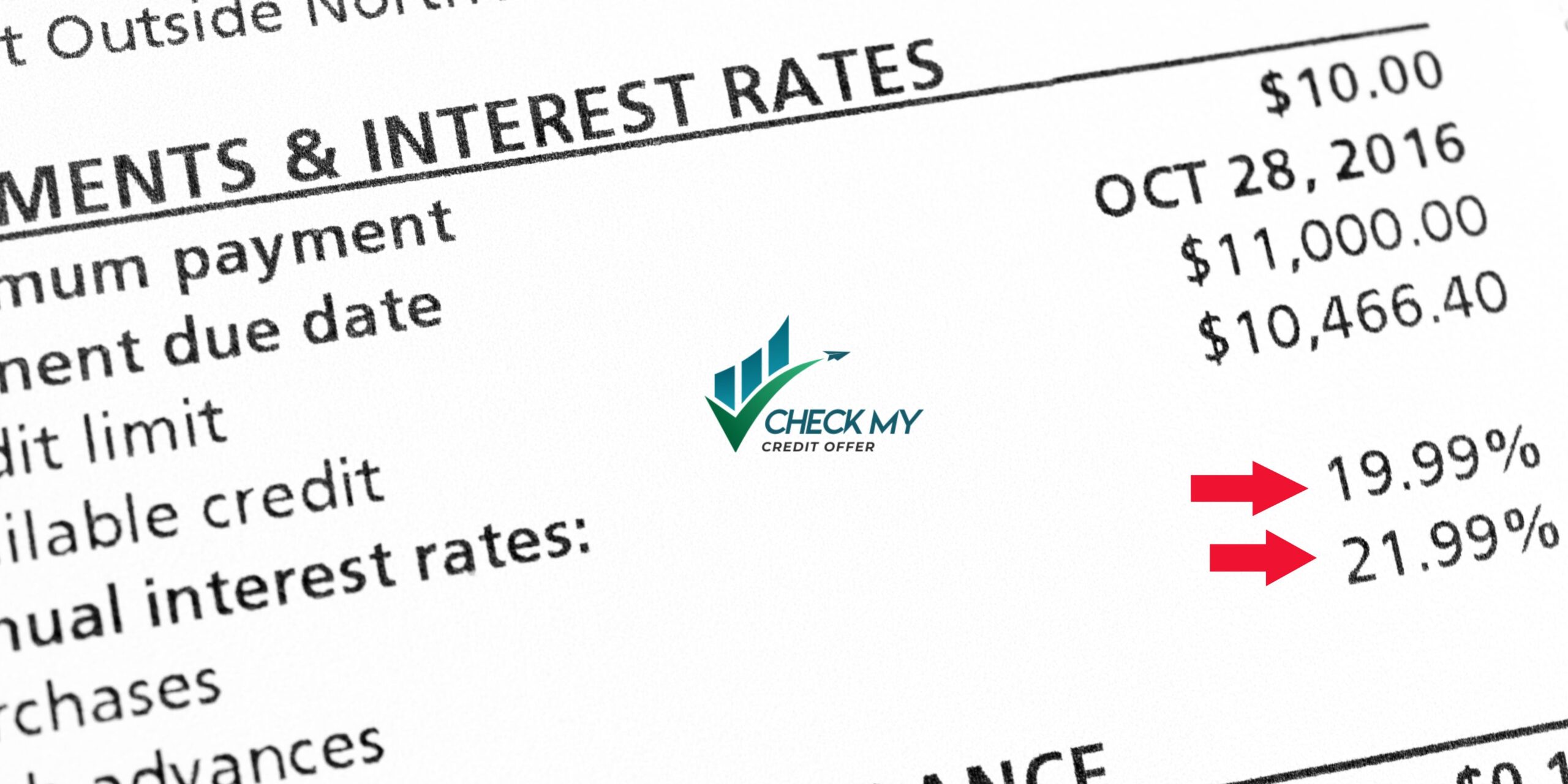

When comparing the best balance transfer credit cards, focus on three factors: the length of the 0% APR period, the balance transfer fee, and any extra benefits like rewards or account bonuses. Below is a simplified comparison of major issuers and their balance transfer credit card offers for 2025:

| Credit Card | 0% APR Period | Transfer Fee | Key Benefits |

|---|---|---|---|

| Chase Slate Edge® | 18 months | 3% intro fee, then 5% | Low intro APR, useful for Chase credit card balance transfer. |

| Capital One Quicksilver | 15 months | 3% | Cashback rewards + Capital One transfer credit card balance option. |

| Bank of America® Customized Cash | 18 billing cycles | 3% | Good rewards + Bank of America transfer credit card balance choice. |

| Citi® Diamond Preferred | 21 months | 5% | Longest 0% APR window available in 2025. |

| Wells Fargo Reflect® | 21 months | 3% | Extra perks like cell phone protection. |

💡 Example: How much will it cost in fees to transfer a $1,000 balance?

If you transfer $1,000 to a card with a 3% balance transfer fee, you’ll pay $30 upfront.

If the card has a promo no balance transfer fee credit card offer, the cost could be $0.

Choosing the right card depends on how quickly you can repay during the 0% APR period.

⚠️ Smart Tip: A longer 0% APR period is valuable only if the transfer fee is reasonable and you have a plan to clear the balance within the promo window.

6. Balance Transfer Credit Cards for Different Profiles

Not every balance transfer credit card is designed for the same borrower. The offers you qualify for will largely depend on your credit profile. Here’s how it breaks down:

✔️ Excellent Credit (Good to Excellent Credit Score)

- Access to the longest 0% APR balance transfer periods (up to 21 months).

- Lower balance transfer fees (sometimes promo no balance transfer fee credit card options).

- Examples: Citi® Diamond Preferred, Wells Fargo Reflect®, Bank of America® Customized Cash.

✔️ Fair Credit

- Shorter promotional periods (typically 6–12 months of 0 balance transfer credit card offers).

- Higher fees compared to excellent credit cards.

- Approval more likely if you maintain steady income and lower debt-to-income ratio.

✔️ Bad Credit

- Most balance transfer credit card for bad credit applicants will not qualify for 0% APR offers.

- Alternatives: secured credit cards, credit-builder loans, or a personal loan for consolidation.

- Focus on rebuilding credit first, then re-apply for stronger balance transfer offers later.

💡 Pro Tip: If you have fair or bad credit, avoid rushing into high-fee offers. Sometimes waiting a few months to improve your credit score will open the door to far better balance transfer credit card offers.

7. Costs & Risks of Balance Transfers

A balance transfer credit card can be a smart tool, but it’s not free money. Before applying, it’s important to understand the hidden costs, risks, and how it can affect your credit score. Many borrowers assume it’s all upside—yet if you don’t use it wisely, you could end up paying more in the long run.

📉 Do Balance Transfers Hurt Credit Score?

Opening a new card adds a hard inquiry to your report, which can temporarily lower your score by a few points. Also, moving debt doesn’t erase it—you’re just shifting it. However, if your new card reduces your overall credit utilization ratio (because of a higher credit limit), your score may actually improve after a few months of on-time payments.

💡 Is It a Good Idea to Do a Balance Transfer on a Credit Card?

Yes—if you have a clear plan. A 0 balance transfer credit card or no interest credit cards balance transfer option can save you hundreds or even thousands in interest. But if you keep spending on the old card without paying down debt, you’re just doubling the problem. The key is discipline: use the transfer to pay off balances faster, not to borrow more.

💰 The Real Cost: Balance Transfer Fees

Most offers charge a balance transfer fee of 3%–5% of the amount transferred. That means even if the interest is 0%, you still pay an upfront cost.

⚠️ Example: How much will it cost in fees to transfer a $1,000 balance to a credit card?

– At 3% fee → $30 upfront.

– At 5% fee → $50 upfront.

If you don’t pay off the balance within the promo period, the new card’s APR (often 18%–25%) will apply, which could wipe out any savings.

⚠️ Other Risks to Watch Out For

- Intro period ends: After 12–21 months, the APR resets to the regular rate, which can be very high.

- Missed payments: One late payment could cancel your 0% APR promo entirely.

- Temptation to spend: Many people keep using the old card, creating double debt instead of reducing it.

✅ Smart Tip: Only transfer what you can realistically pay off during the 0% APR period. Avoid treating it as “free money”—it’s a tool to save interest, not an excuse to keep swiping.

💳 Balance Transfer Fee Calculator (Example: $1,000 Balance)

| Fee % | Cost in $ | Total Balance |

|---|---|---|

| 3% | $30 | $1,030 |

| 4% | $40 | $1,040 |

| 5% | $50 | $1,050 |

⚠️ Even at 0% APR, the transfer fee adds up—so make sure the savings outweigh the cost.

8. Top Banks & Issuers – Balance Transfer Offers

Major U.S. banks provide competitive balance transfer credit card offers. Below is a quick comparison of

popular issuers like Chase, Capital One, Bank of America, Discover, and Wells Fargo.

Each comes with its own mix of 0% APR periods, fees, and rewards. Always review the terms before applying.

| Bank / Card | 0% APR Period | Transfer Fee | Highlights | Apply |

|---|---|---|---|---|

| Chase Slate Edge® | 18 months | 3% intro, then 5% | Low intro APR – Chase balance transfer option | Apply |

| Capital One Quicksilver | 15 months | 3% | Cashback + Capital One transfer credit card balance | Apply |

| Bank of America® Customized Cash | 18 billing cycles | 3% | Good rewards + Bank of America transfer credit card balance | Apply |

| Discover it® Balance Transfer | 18 months | 3% | Cashback match + flexible balance transfer credit card offers | Apply |

| Wells Fargo Reflect® | 21 months | 3% | Longest intro APR + phone protection | Apply |

⚠️ Note: Terms and offers may change. Always double-check the official bank page before applying.

Pro Tips – Pick the Right Issuer

- Chase (Slate Edge): Good if you want a solid 0% APR window plus the chance to lower APR over time with on-time payments.

- Capital One (Quicksilver): A balance transfer option that also gives simple cashback on everyday purchases.

- Bank of America (Customized Cash): Flexible rewards on spending categories + decent transfer terms.

- Discover it® Balance Transfer: Great if you like the cashback match bonus in the first year along with a competitive transfer offer.

- Wells Fargo Reflect®: Often one of the longest intro APR periods available, plus perks like cell phone protection.

✅ Rule of Thumb: If you can pay off the balance during the 0% period, go for the longest window even with a 3% fee.

If you’ll need more time or plan to make new purchases, look for a card with a lower ongoing APR, even if the transfer fee is 5%.

9. FAQs – Balance Transfer Credit Cards

❓ What is the best balance transfer card right now?

It depends on your profile. For long 0% APR periods, cards like Citi® Diamond Preferred and Wells Fargo Reflect® stand out. If you want rewards plus a balance transfer credit card, Discover it® Balance Transfer or Capital One Quicksilver can be solid options.

❓ Can I transfer balances between cards from the same bank?

No. Banks typically don’t allow a balance transfer between their own cards. For example, you can’t transfer from one Chase card to another Chase card—you’d need a different issuer.

❓ Are fees always the same for balance transfers?

Most issuers charge a 3% fee, but some charge up to 5%. Rarely, you might find balance transfer credit card no fee offers, but they’re usually limited-time promos.

❓ Is it a good idea to do a balance transfer on a credit card?

Yes, if you use it wisely. A low APR balance transfer credit card with 0% APR can save you interest. But if you don’t pay off the balance before the promo ends—or if you keep spending on the old card—it can backfire.

❓ How much will it cost in fees to transfer a $1,000 balance to a credit card?

At 3% fee, you’ll pay $30. At 5%, it’s $50. Even with 0% APR, these upfront costs matter—make sure the savings outweigh the fees.

❓ Do balance transfers hurt credit score?

They can cause a small dip at first due to the hard inquiry and new account. But if the transfer lowers your credit utilization and you pay on time, your score could improve over time.

10. Conclusion

A balance transfer credit card can be one of the smartest financial tools if you’re carrying high-interest debt. By moving your balance to a card with 0% APR, you gain valuable breathing room to pay down what you owe faster and with fewer costs. The key is understanding the fees, promo period, and your own repayment plan.

This strategy is best for people with good discipline—borrowers who can commit to paying down the balance before the intro period ends. If that sounds like you, a balance transfer could save you hundreds or even thousands in interest.

✅ Check the best balance transfer credit card offers today and see if you qualify—without hurting your credit score.