Capital One Reservation Code: How to Use It to Apply Online

Capital One Reservation Code is a unique, pre-selected identifier that links you to a tailored credit-card offer. It tells Capital One you’ve already met initial criteria, which can speed up the application and improve your likelihood of approval—often with better terms or perks than public offers.

In this guide, you’ll learn exactly where to find your code, how to enter it on the official site safely, and what to check before you submit so you don’t miss out on intro APRs, cashback, or travel rewards.

- What the reservation code means & who gets one

- Step-by-step: redeeming it at Getmyoffer.CapitalOne.com

- Security tips to avoid fake links and protect your data

Step-by-Step: Redeem Your Capital One Reservation Code at Getmyoffer

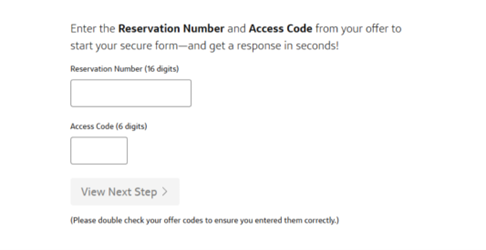

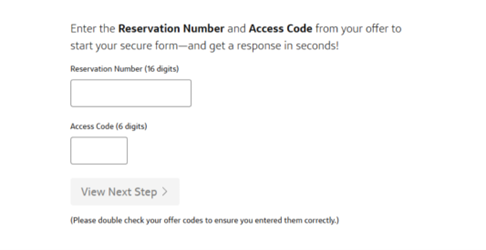

Capital One Reservation Code lets you go straight to your personalized offer: visit

capitalone.com/getmyoffer, enter your

16-digit reservation number and 6-digit access code, confirm your ZIP and last name, review the offer’s rates, fees, and perks, then submit.

How Getmyoffer Is Used by Capital One Reservation Code for CapitalOne Com

Capital One developed the reservation code you receive as a special identification to expedite the application process for qualified applicants. This code takes you straight to a credit card offer that is customized based on your creditworthiness and financial history. It’s a special invitation to apply for a Capital One card, which gives you access to customized terms and a better chance of getting approved.

Here Steps to Use Your Getmyoffer.CapitalOne.com Reservation Code:

- Capital One reviews your financial history through a gentle inquiry.

- They assess your income level, payment history, and credit score.

- They provide you with a customized reservation number if you are eligible.

- Go to CapitalOne.com/Getmyoffer.

- Enter your personal information and reservation code.

- Avoid certain stages of the conventional application procedure.

- View the whole terms and perks of your special credit card offer.

Who Gets a Reservation Code for Getmyoffer CapitalOne Com?

Choosing who gets a reservation code is a selective technique used by Capital One. People who fulfill specific predetermined financial requirements are typically the ones who receive these offers. Capital One uses data from credit bureaus to find applicants that exhibit sound financial practices, like steady income, low credit utilization, and a history of on-time payments.

The likelihood of receiving a pre-approved offer is higher for those with outstanding or excellent credit scores, while there is no set formula. Furthermore, these offers are typically made to people who have a solid credit history, moderate debt, and sound financial habits. Even those who are establishing or repairing credit, nevertheless, might be given a reservation code, particularly if their credit score has just improved.

It’s necessary to keep in mind that obtaining a reservation number just indicates a greater chance of acceptance; it does not ensure approval. To make sure your financial situation satisfies the offer requirements, Capital One will still thoroughly examine your application. You will be able to benefit from special conditions catered to your profile if you are accepted.

The Benefits of Making Use of a Pre-Approved Reservation Code

Utilizing a pre-approved reservation code with Getmyoffer.CapitalOne.com has many advantages. First, it offers a simpler route to credit card approval, lessening the anxiety and ambiguity that conventional credit applications can entail.

An increased probability of approval is one of the main benefits. Since Capital One has already analyzed a piece of your financial background, the reservation code essentially pre-screens you for eligibility. Because you’re not beginning from zero, this method saves you time and improves your chances of success. Furthermore, your credit score is unaffected by this pre-approval because it simply entails a “soft inquiry” on your credit record. Capital One will only perform a “hard inquiry” after you decide to apply, which could momentarily reduce your score.

| Benefit | Description |

|---|---|

| Faster Application Process | Using a pre-approved reservation code streamlines the application, often leading to quicker processing. |

| Higher Approval Chances | Pre-approval indicates that Capital One has already identified you as a potential match, increasing your likelihood of approval. |

| Access to Exclusive Offers | Reservation codes may grant access to special terms, such as lower interest rates or introductory offers. |

| Personalized Credit Terms | Offers are typically tailored to your financial profile, providing credit limits and terms suited to your needs. |

| Minimal Impact on Credit Score | Pre-approval is usually based on a soft inquiry, which doesn’t affect your credit score. |

| Convenient Online Application | Entering your code on Capital One’s website allows you to complete the application process online efficiently. |

| No Obligation to Accept | Receiving a pre-approval code doesn’t obligate you to accept the offer, giving you flexibility to compare options. |

| Improved Credit Management Options | Many pre-approved offers include features like rewards programs or cashback, |

A pre-approved offer also gives you access to exclusive terms and advantages. Special incentives are often included in reservation code offerings to draw in new cardholders. These could include exclusive promotional incentives, increased credit limits, or reduced interest rates. For instance, you might get greater cashback rates on specific kinds of purchases or get a bonus for spending a certain amount within the first few months.

The application process may also be more convenient if a reservation code is used. Instead of completing a long application, you examine the details of your offer by entering your code and verifying your identification. This expedited procedure can result in a faster answer; in many situations, you can check the status of your application quickly and find out if you’re approved in a matter of minutes.

How to Use Getmyoffer.CapitalOne.com to View Your Offer

- Using Getmyoffer.CapitalOne.com to access your exclusive offer is simple and just requires a few essential facts. Start by going to the website and finding the sections where you will input your reservation code along with some basic data, including your ZIP code and last name. These particulars confirm your identification and guarantee that the right person receives the offer.

- After entering this information, a page with your individual offer, along with the credit card’s features, advantages, fees, and other important terms, will be displayed. Spend some time carefully going over this information. Capital One offers a range of credit-building, travel rewards, and cashback cards, each of which is intended to meet distinct financial requirements.

- You can proceed to finish the application by providing any more information that is needed if the offer fits your financial objectives. This could include information about one’s salary, job, and other personal characteristics. To make the final decision, Capital One will perform a hard inquiry on your credit report after receiving your application.

capitalone.comو

getmyoffer.capitalone.com.Ensure the address bar shows https://, avoid third-party links/ads, and never share your code via email or chat.

The Getmyoffer.CapitalOne.com portal makes it easy to access your offer and apply by streamlining the application procedure.

How to Use the Pre-Qualification Tool without a Reservation Code

What Is the Capital One Pre-Qualification Tool?

If you haven’t received a reservation code or a pre-approved application but want to explore Capital One’s credit-card options, the pre-qualification tool is a solid alternative. By entering a few basics—your name, address, and Social Security number—the tool runs a soft inquiry (no score impact) to check which cards you may be eligible for.

Benefits of Using the Tool Without Applying

- Preview potential card matches without committing to an application.

- Compare each card’s benefits, terms, rates, and fees before you decide.

- Avoid a hard inquiry—results are based on a soft pull only.

Try it on Capital One’s official page:

capitalone.com/credit-cards/prequalify/

🔒 Security tip: Only use the pre-qualification tool on capitalone.com over https://. Avoid third-party links or ads claiming to “pre-approve” you.

A Smarter Way to Explore Card Options

If you’re looking for a new credit card but want to prevent the temporary impact of a “hard inquiry” on your credit score, using the pre-qualification tool is a good idea. It’s also a wonderful method to look into other Capital One card alternatives than those available through pre-approval invitations.

Common Questions About Getmyoffer: CapitalOne.com Reservation Code Offers

Many potential candidates have doubts about how Getmyoffer.CapitalOne.com works, especially since pre-approval can sometimes be confusing. Below are some of the most frequently asked questions about reservation code offers:

- 1. Is a pre-approved offer a guaranteed acceptance?

No, preapproval does not ensure admission. While having a reservation code suggests a better possibility of approval, Capital One will still conduct a thorough evaluation of your application. Any substantial changes in your financial profile, such as a decline in credit score or high debt levels, may influence the final decision. - 2. Will using the reservation code impact my credit score?

The initial step of entering your reservation code and viewing your offer results in a soft inquiry that does not affect your credit score. If you opt to move forward with the application, Capital One will do a hard inquiry, which may temporarily reduce your credit score by a few points. - 3. Can I apply for another card if I have a pre-approval?

Yes, if the card linked to your reservation code does not meet your needs, you can look at other Capital One possibilities. The pre-qualification tool on Capital One’s website is a good method to look at different options. However, applying for a different card may result in a new hard investigation, so think about your options carefully. - 4. What happens if my reservation code is lost?

Don’t worry if you misplace your reservation code. Based on your details, Capital One customer service might be able to get the code for you if you get in touch with them. As an alternative, you can apply for a card straight from the website without using the reservation code, although the terms might differ from those of your pre-approved offer. - 5. Do offers that are pre-approved expire?

Indeed, pre-approved offers usually have a deadline. Usually, the invitation you got will specify this deadline. To benefit from the conditions and advantages of your pre-approval, make sure to apply before the offer ends.

These frequently asked questions might help clear up any confusion about utilizing the Getmyoffer.CapitalOne.com reservation code, allowing you to make the best decision possible on your credit possibilities.

Making the Most of Your Capital One Credit Card Advantages

There are strategies to optimize your Capital One credit card’s perks after you’ve been authorized for one at Getmyoffer.CapitalOne.com. Getting the most out of your account can be achieved by understanding how to take use of the various card kinds that Capital One offers, each of which has special benefits.

For example, if your card provides cashback benefits, use it for regular transactions so you can get a portion of your purchases back. Higher cashback rates are available on some Capital One cards for particular categories, such as groceries, restaurants, or gas. If you have a travel-focused credit card, consider utilizing rewards for travel, lodging, and rental cars. To find the best offers, keep an eye out for Capital One’s alliances with airlines and travel websites.

In addition, maintaining your card can be made much simpler by utilizing the Capital One mobile app. You may check your points balance, receive real-time spending notifications, and use the tools to set up recurring payments to prevent late fees. Additionally, Capital One offers tools like credit tracking and fraud monitoring to help you manage your finances and maximize the benefits and incentives offered by your card.

How to Proceed Should Your Application Be Rejected

• Recognize the Reasons Behind Your Rejection

Usually, Capital One will give you a letter outlining the precise reasons why your application for a Capital One card was rejected. Typical explanations include:

- High ratio of debt to income

- Late payments in recent years

- Limited or brief credit history

You can use these insights to determine which aspects of your financial profile require improvement.

• Do Something to Improve Your Credit

Improve your credit profile after you’ve determined the reason for the denial.

This may consist of:

- Resolving current obligations

- Regularly making payments on time

- Lowering the total amount of credit you use

These actions can eventually raise your credit score and improve your chances of getting approved again.

• Use the Pre-Qualification Tool Once More.

Use Capital One’s pre-qualification tool to see whether you qualify for any new offers after a few months of credit improvement. This will not have an impact on your credit score.

• Investigate Other Options for Developing Credit

Consider applying for credit cards that are intended for credit building or repair if your profile still needs improvement.

Secured credit cards are an excellent choice because they help you build a good payment history and require a refundable deposit.

Options for Getmyoffer CapitalOne Com customer service

For a smooth experience, Capital One offers a number of customer service resources in case you need help or have concerns about your Getmyoffer.CapitalOne.com offer. To get information about your reservation code, application status, or card advantages, you can call Capital One and speak with personnel.

Additionally, Capital One provides online assistance via their website, which includes a thorough frequently asked questions section and a live chat function for prompt responses to frequently asked questions. The Capital One mobile app offers extra features for those who would rather handle their accounts digitally, including the opportunity to check your offer, track the status of your application, and create alerts.

The goal of Capital One’s support services is to walk you through the procedure, explaining each step and assisting you in resolving any possible problems. By making use of these tools, you may confidently use your Capital One application and get prompt support when you need it.

Next Steps with Capital One

Used your code? Here’s what to do next.

Conclusion

The Getmyoffer.CapitalOne.com reservation code gives you access to special credit card choices based on your financial situation. This pre-approval procedure streamlines the application, increases the likelihood that it will be approved, and may result in customized benefits and rewards. You can make an informed decision that advances your financial objectives by following the instructions in this book, which cover everything from comprehending the function of your reservation code to optimizing your card’s perks.

This guide gives you the tools you need to confidently manage your financial future, regardless of whether you have a reservation code or are thinking about one of Capital One’s other credit card options.