Credit Card Terms Explained – A Beginner’s Guide to Key Definitions

Credit cards are money giants, but they come with a language of their own. From APR to grace period, becoming fluent can be the key to paying less than you must in fees and getting the most out of your credit benefits. Regardless of whether you’re new to credit or merely new to paying attention to your statements, this beginner’s primer will lead you step by step through the key credit card terms, what they are, and why they’re crucial to you. Why It Pays to Know Your Credit Card Terms

Why It Pays to Know Your Credit Card Terms

Avoiding Fees You Don’t Need

Ignorance of the fine print is one of the primary causes of credit card problems. Being aware of what words such as “APR” or “grace period” mean can prevent you from getting caught with late fees, interest, and penalties.

This beginner’s guide explains credit card terms in plain English so you can compare offers and avoid unnecessary fees.

Making Smarter Financial Decisions

Learning credit card slang makes you stronger to shop around for offers, choose the right card for your case, and keep an eye on your credit record. You are thus master of your destiny.

Credit Card Slang That You Must Master

Annual Percentage Rate (APR)

APR is the cost of borrowing money per year as a percentage. It includes interest and any fee. Various APRs might be quoted on purchases, cash advances, and balance transfers.

Interest Rate vs APR

Although used interchangeably, the interest rate would typically be employed to describe merely the cost of borrowing, while the APR includes the charge as well as the interest. The APR is a wider expression of cost.

Credit Limit

Your credit limit is the maximum you can spend with your credit card. Charging more than this can cause transactions to be declined as well as fees.

Available Credit

This is available to you but not being used. This is found by subtracting your current balance from your total credit limit.

Grace Period

Grace period is the time from the end of your billing cycle through the payment due date. If you pay your balance in full during this period, you will not be charged interest on purchases.

Minimum Payment

This is the minimum amount you are required to pay by the due date to maintain an active account. Paying the minimum will lead to long-term debt and high interest payments.

Before you apply, review the credit card terms for APR, fees, grace period, and dispute rights.

Balance Transfer

Balance Transfer

Shifting debt from one credit card to another, usually to earn a reduced rate of interest. Understand the balance transfer fee and for how long the promotional rate holds good.

Cash Advance

You’re borrowing on credit in the form of cash advance. They have a higher APR and no grace period, thereby are costlier.

Statement Balance vs Current Balance

Statement Balance: The total amount you owe as of the closing of your billing cycle.

Current Balance: The amount currently due, for example, new charges that have not yet posted on your account.

Foreign Transaction Fee

This one’s assessed when you purchase something in a foreign currency or using a foreign bank. It’s typically 1% to 3% of the cost of the item.

Late Payment Fee

If you’re late with a payment, your issuer charges a late fee, which rises with each late payment and hurts your credit score.

Little-Known Terms You Should Know

Introductory APR

Most credit cards have a low or 0% introductory APR (e.g., 12-18 months). Then the APR will rise. This is convenient for big purchases or balance transfers.

Credit Utilization Ratio

This is between overall credit card balances and total credit limit. Having a low utilization ratio is good for your credit score. Less than 30% is advised by experts.

Secured vs Unsecured Card

Secured Card: Has features like having a cash deposit kept as collateral.

Unsecured Card: No downpayment is provided and is common in good credit.

Chargeback

Chargeback: A refunding of a charge to your card issuer when you refuse a charge, i.e., for fraud or inferior goods/services.

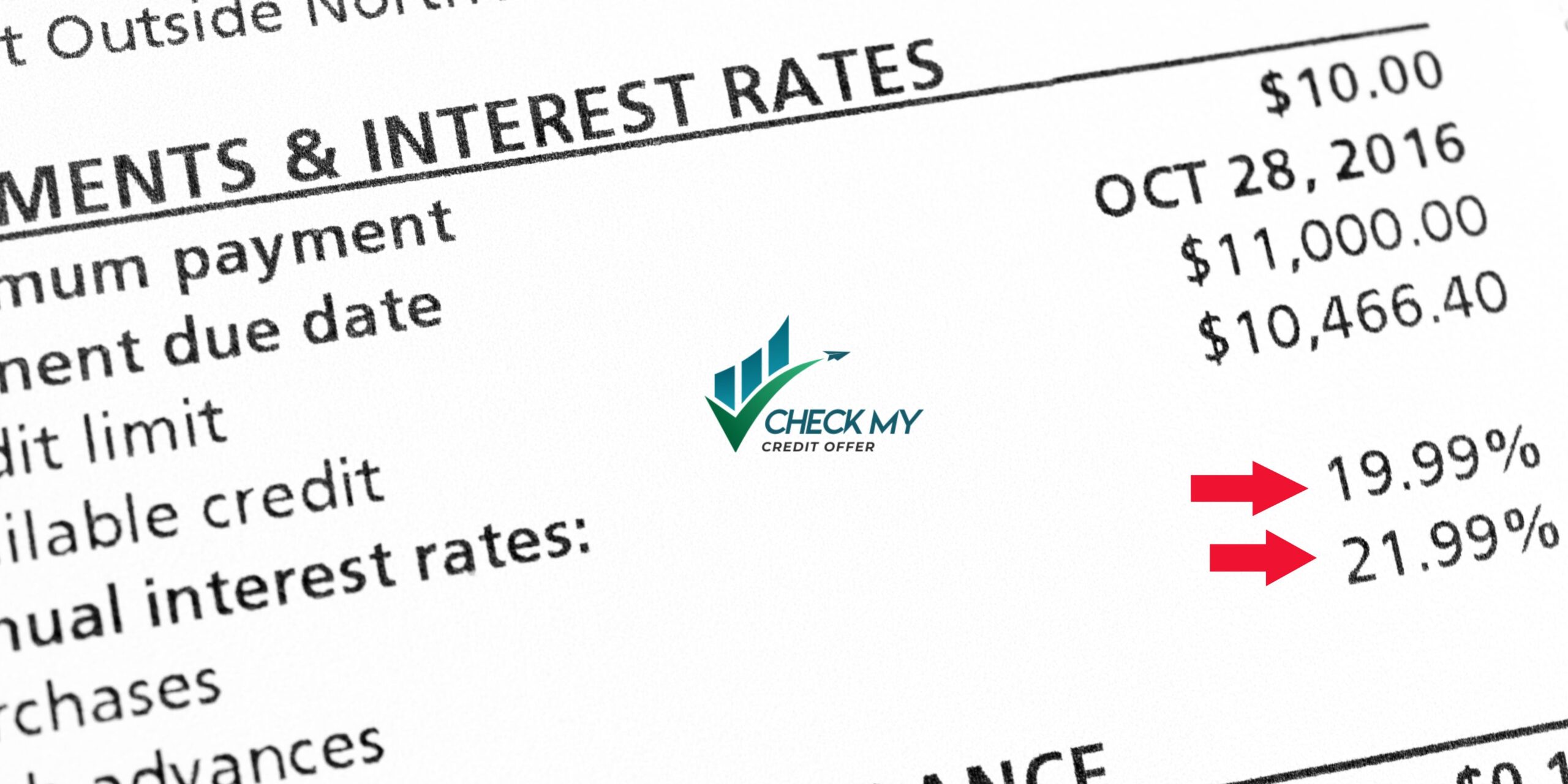

Variable vs Fixed APR

Variable APR: Can change based on an index interest rate like the prime rate.

Fixed APR: Is set, but issuers may still revise with notice.

Reading the Fine Print Tips

Where to Find Key Information

All of the credit card terms are found in the cardholder agreement and summary of terms. Look for them prior to applying, usually on the card issuer’s website or app website.

Questions to Ask Prior to Applying

- What is the post-intro APR that is charged?

- Are there foreign transaction or annual fees?

- What is the fee for late payment?

- Is there a rewards or cashback card?

- What is the credit limit and how is it determined?

Playing ahead of time is capable of preventing surprises and selecting the card that most efficiently suits your financial life and requirements.

Quick definition: credit card terms are the rules and costs of your account (APR, fees, grace period, limits). Knowing them helps you avoid interest and penalties.

Schumer Box — Read This Before You Apply

The Schumer Box is a standardized table every U.S. issuer must show that summarizes key rates and fees (purchase, balance transfer, cash advance APRs; annual, late, foreign fees). Use it to compare cards apples-to-apples before applying.

- Find it on the card’s application page or card agreement.

- Look for rows like “How to Avoid Paying Interest on Purchases,” “Penalty APR,” and “Foreign Transaction Fee.”

- Confirm the intro period length and what happens after it ends.

Deferred Interest vs 0% Intro APR (Not the Same)

- 0% Intro APR: no interest during promo; after it ends, interest applies only going forward on any remaining balance.

- Deferred Interest: if you don’t fully pay by the deadline (or miss a payment), you can owe retroactive interest back to the purchase date—common on many store cards.

- Smart move: set autopay to clear the balance a few days before the promo ends.

Grace Period & Cash Advances — Know the Limits

- Grace period: usually applies to purchases if you pay in full by the due date. It’s not guaranteed and may not apply to balance transfers or cash advances.

- Cash advance: typically has no grace period, higher APR, and a separate fee—interest starts immediately.

- Tip: avoid new purchases on a card carrying a transferred balance to keep your purchase grace period.

Penalty APR & Autopay Safety

- Penalty APR: missing payments can trigger a much higher APR. Issuers must re-evaluate periodically; get back to on-time payments to restore your rate.

- Autopay options: set to “statement balance” to avoid interest, or “total balance” if you want a zero balance at all times, and confirm the withdrawal date is before the due date.

Helpful Official Links (U.S.)

Quick access to regulations, agreement database, and autopay guidance from CFPB.

Reg Z §1026.59 — Reevaluation of Rate Increases (Penalty APR)

Know Before You Owe — Credit Cards (Penalty APR & Late Fees)

CFPB Credit Card Agreement Database (find your Schumer Box)

How Automatic Debits (Autopay) Work

How to Stop Automatic Payments (Stop-Payment Order)

Your Protections for Automatic Debits

Latest: Credit Card Penalty/Late Fee Rule Updates

Your Rights Under the Fair Credit Billing Act (FCBA)

The FCBA gives U.S. consumers strong protections for billing errors and disputed charges on credit cards. Use these steps to preserve your rights and resolve issues efficiently.

How to Dispute a Billing Error (within 60 days)

- Review your statement: identify the exact charge, date, and amount.

- Write to the issuer’s “Billing Inquiries” address: send a written letter (not just online chat) so it reaches the issuer within 60 days of when the first statement with the error was sent.

- Include evidence: copies of receipts, screenshots, correspondence, and what you want the issuer to do.

- Send by certified mail (recommended): keep copies and the return receipt.

- Pay the undisputed amount: you don’t have to pay the disputed amount while it’s under investigation, but keep the rest current.

- Watch the timelines: the issuer must acknowledge your dispute within ~30 days (unless resolved sooner) and investigate within two billing cycles (no more than ~90 days).

What Counts as a Billing Error?

- Unauthorized or incorrect charges (wrong amount/date), math errors, or charges for goods/services not received or accepted.

- Charges not properly credited to your account or not sent to your correct address.

Chargebacks vs. Merchant Disputes

Try the merchant first. If not resolved, file a dispute with your issuer under FCBA. Keep timelines and documentation to strengthen your case.

Late Fees — Check the Schumer Box

Late-fee caps have been subject to litigation and policy changes. Because amounts can vary by issuer and change over time, always verify the current late fee in the card’s Schumer Box before applying.

FAQs About Credit Card Terms

What are credit card terms?

They’re the costs and rules of your account—APR, fees, grace period, limits, and dispute rights. Read the issuer’s Schumer Box to see the exact credit card terms before you apply.

What is APR on a credit card?

APR means Annual Percentage Rate. APR refers to the cost of borrowing on your credit card for one year, and this includes interest and some charges.

What is statement balance vs. current balance?

Your account statement will show how much you are currently owing from your last billing cycle. Current balance is the amount you’ve been charged since the last billing cycle.

Will paying the minimum be bad for my credit score?

No, if you pay the minimum, your payment history is fine. Paying a balance will hurt your score indirectly by raising your utilization, though.

Is a balance transfer worth it?

Yes, if you’re moving high-interest balances to a card with a 0% intro APR and pay it off within the promo period.

What is a secured credit card good for?

Secured cards are wonderful for building or restoring credit. Your deposit is collateral, so it’s not such a big risk for the lender.

How does a cash advance work?

You use your credit card to cash out, either at a bank or ATM. It has high fees and interest from day one, so it’s wise to stay away from it unless absolutely necessary.

Where can I find my credit card terms online?

Check the issuer’s application page, the cardholder agreement, or the CFPB agreement database. Always confirm the latest credit card terms for APRs and fees.

Conclusion – Speak the Language of Credit Like a Pro

Credit cards are very convenient or even financially risky depending on how well you know them. Knowing what APR, grace period, or balance transfer is will place you to make a smart choice.

CTA: Are you ready to break up with your credit card offer? Bookmark this glossary so you remain educated and financially in control. The more you are informed, the better you handle credit wisely.