How to Improve Your Credit Score

Your credit score is not a number—it’s a measure of your financial skills and a huge determinant of your credit limit. If you’re seeking a new credit card, a mortgage, or just enjoy the benefits of lower interest rates, it’s worth keeping credit healthy. In this definitive guide, we’ll cover what your credit score is, how it gets affected, and how to make the most out of your own step by step.

Understanding Credit Scores

What Is a Credit Score?

A credit score is a three-digit number ranging from 300 to 850 that reflects your creditworthiness. Lenders use this score to assess the likelihood that you’ll repay your debts. The higher your score, the better your chances of getting approved for loans and credit cards with favorable terms.

Why Does Your Credit Score Matter?

Your credit score affects more than loan approval. It can influence:

- Interest on credits and loans

- Rent lease approval

- Auto insurance rates

- Employment opportunities (in some professions)

A good credit score opens the door, and a bad one closes the door. With an excellent credit score, you can get approved for lower interest rates, which will save you hundreds or even thousands of dollars over the life of a mortgage or car loan. Even your landlord and utility company might consider your rating to determine if you are a safe bet.

What Affects Your Credit Score

Payment History

This is the most crucial factor and carries around 35% of your weightage. Payment misses, defaults, and collections can cause a lot of damage. A single payment miss can decrease your score by considerably.

Credit Utilization Ratio

This is the credit available to you that you are utilizing. Your usage needs to be kept below 30% of your total credit limit. It constitutes 30% of your score. To reduce this ratio is one of the fastest ways to raise your score.

Length of Credit History

The longer, the better. This encompasses the age of your oldest account, the average age of all of your accounts, and how long ago each account was last used. Established accounts demonstrate consistency and experience with credit management.

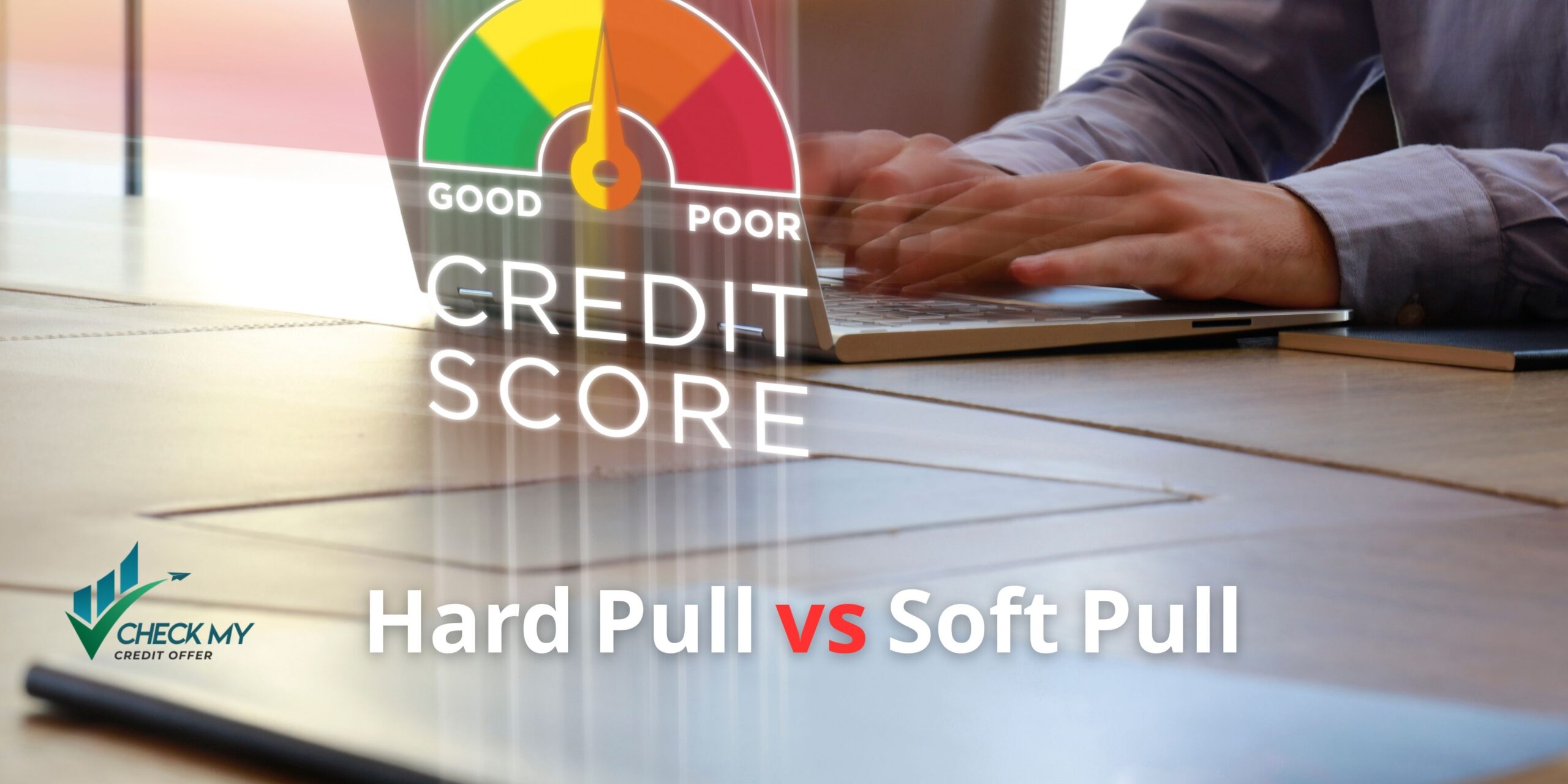

New Credit Inquiries

Each time you apply for new credit, a hard inquiry is performed. Too many too closely together can lower your score. Banks may assume several requests indicate that you are in financial distress.

Types of Credit Accounts

A nice mix of different types of credits—credit cards, installment loans, auto loans, etc.—can help raise your score. This aspect holds about 10% of your credit score. Equal credit history is better.

Best Ways to Improve Your Credit Score

Pay Bills on Time

Set reminders, make payments automatically, or use apps to track due dates. Payment history is responsible for your largest percentage of score. Set reminders on your phone or calendar in order to avoid late payments.

Lower Your Credit Card Balances

Attempt to keep your usage level under 30%, and preferably under 10%. This shows lenders that you are a responsible credit user. Clearing your balances in full each month when the statement is closed can serve to show lower usage.

Do Not Open Too Many New Accounts

New credit applications will lower your score temporarily. Use credit only when you really need it. Space out app requests and find out how likely you are to qualify before applying.

Become an Authorized User

Have a family member with good credit add you as an authorized user. You benefit from their good track record without being responsible for it. It’s a nice way of starting fresh.

Dispute Credit Report Errors

Mistakes on your credit report can hurt your score. Check your Equifax, Experian, and TransUnion credit reports at AnnualCreditReport.com, and dispute any mistakes. Even small mistakes can harm your score.

Raise Your Credit Limit

If you have high use of your available credit, attempt to ask for a credit limit increase. An increase in your credit limit lowers your utilization ratio—unless you use it to purchase more items.

Use Credit in a Way That Helps You in the Long Run

Healthy credit habits cause lasting improvement over time, and that serves you well by increasing your score.

How Long Will It Take to Increase Your Score?

Fast Fixes vs. Long-Term Benefits

Fast fixes are:

- Pay off rotating balances

- Correct mistakes on your report

- Become an authorized user

Long-term benefits are:

- Paying as agreed, on time, and regularly

- Building a longer credit history

- Maintaining low balances over time

What to Look for in 30, 60, and 90 Days

- 30 Days: Disputes settled, payments made, new limit requests answered

- 60 Days: Lower use starts to pay off; on-time payments become second nature

- 90 Days: Ongoing on-time payments, no new requests, and consistent activity means good progress

Remember: credit healing doesn’t happen overnight, but it’s always a wait worth it.

Mistakes That Damage Your Credit

Missing Bills or Late Payments

Miss one payment and your rating tanks. Two or three days late will have a lasting impact.

Maxing Out Credit Cards

Large balances alert lenders to danger. Paying in full won’t be a problem, but paying low balances within the billing cycle is wise.

Applying for Too Much Credit at Once

Multiple applications translate to cash problems. Space out requests and aim to have accounts available that you already possess.

Closing Old Credit Accounts

While closing unused cards might be a good practice, closing them will lower your average account age and overall available credit—both of which are negatives for your score.

U.S.-Specific Essentials for Credit Scores

- Get free weekly credit reports at AnnualCreditReport.com from Equifax, Experian, and TransUnion.

- Place or lift a free credit freeze anytime to help prevent identity theft.

- Mortgage/auto/student loan rate shopping within ~45 days often counts as one inquiry.

- Medical collections: paid items removed; new medical collections wait 1 year; under $500 are excluded.

- Which score do lenders use? Many use FICO; mortgages may use Classic FICO or VantageScore 4.0 (transition to newer models is underway).

How to Dispute Credit Report Errors (FCRA Basics)

- Get your report and highlight each error.

- Dispute with the credit bureau (and the furnisher) in writing; include evidence and what you want corrected.

- Investigations generally conclude in ~30 days (may extend in limited cases). You will be notified of results and get an updated report if changed.

Frequently Asked Questions About Credit Scores

Can I improve my credit score quickly?

Yes, there are some strategies (like lowering usage or disputing errors on your report) that can create fast change.

Will looking at my own credit score lower it?

No. Checking on your own credit is a soft pull and won’t hurt you.

Is closing unused credit accounts ever a good idea?

Not always. Closing old accounts decreases your credit history and could hurt your score.

How frequently should I check my credit report?

Check weekly for free at AnnualCreditReport.com from Equifax, Experian, and TransUnion.

Is debt-free a good credit score?

No. Credit scores are based on credit conduct. No use of credit = less to rate.

Can I build credit without a credit card?

Yes, through sources such as credit-builder loans, rent reporting, and as an authorized user.

What is the fastest method to boost my credit score in 30 days?

Decreasing outstanding credit card debt and removal of any inaccurate negative accounts.

Should I place a credit freeze?

A credit freeze is free and doesn’t affect your score. It helps prevent new accounts being opened in your name. You can temporarily lift it when you apply for credit.

Do mortgage/auto rate-shopping inquiries count as one?

Multiple inquiries for the same type of loan within a short window (around 45 days) are often treated as a single inquiry by many scoring models.

Which score do lenders use—FICO or VantageScore?

Many lenders use FICO. Mortgage lenders historically use classic FICO models, with a transition to newer models (like FICO 10T and VantageScore 4.0) underway.

Do medical debts affect my credit score?

Paid medical collections are removed; new medical collections have a one-year waiting period; and many under $500 are excluded. Policies continue to evolve, so always review your latest report.

How long do credit report disputes take?

Bureaus typically have about 30 days to investigate disputes (up to 45 days in some cases). You will receive results and an updated report if changes are made.

Final Tips – Start Improving Your Score Today

It does cost time and effort, but it is worth it. Start with examining your credit report, marking areas for improvement, and using the methods we’ve outlined here. If you’re trying to get a loan, get better credit card rates, or simply feel more financially secure, raising your score is an intelligent and empowering decision.

Ready to boost your credit score? Use these real-life tips today and begin building towards a healthier economic future. Don’t wait—every smart credit decision you make today builds a stronger economic future.

Useful Resources:

- AnnualCreditReport.com

- Equifax, Experian, and TransUnion credit score education

Naturally occurring keywords utilized throughout the article:

- how to raise credit score

- how to improve your credit score

- improve credit score fast

- credit score tips

- how to increase credit score quickly

- fix bad credit score

- ways of enhancing credit score

- enhance credit score in 30 days

- how to build credit

- how to enhance credit score